Child Financial Exploitation (CFE)

What is Child Financial Exploitation?

Child Financial Exploitation, sometimes referred to as 'money muling', is the term used to describe the action of using a young person’s bank account to move money obtained from illegal sources.

Through the process of money laundering, criminals will introduce the proceeds of their crimes into the banking system as a way of attempting to disguise its origin, making it appear as though it has come from a legitimate source.

Laundering the proceeds of crime is a criminal offence under The Proceeds of Crime Act (2002) and carries a maximum prison sentence of up to 14 years.

Spot the Signs

Watch Gabi's story below to find out about the signs to spot:

Consequences

Whilst most young people who are financially exploited will not realise they have transferred money generated from criminal activity through their account, doing so could lead to a number of consequences, including:

- Bank account being frozen, unable to open another account.

- Unable to get a phone contract or other loans.

- Unable to apply for student finance with no bank account.

- Difficulty getting a job with no bank account.

- Criminal conviction - laundering the proceeds of crime.

Victim of financial exploitation?

As Fearless is 100% anonymous, we are unable to take reports from victims of crime.

If you are being financially exploited it’s really important that you talk to a parent/guardian, an adult you trust or report it to the police.

You can also get more information, support and advice from the organisations listed on our youth support services page.

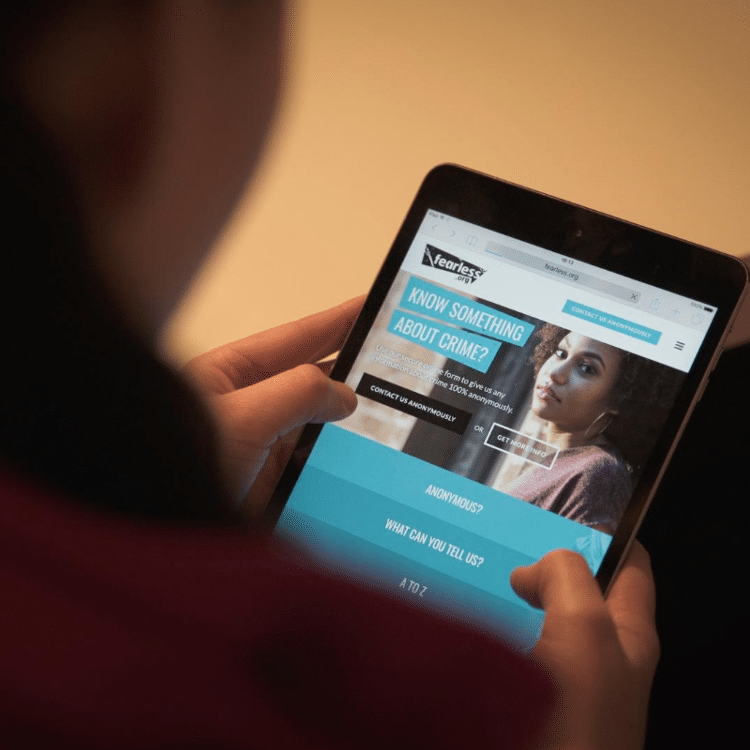

Anonymity

Fearless is a service that allows you to pass on information about crime 100% anonymously. Anonymous means your identity is completely unknown.

Give information anonymously

Report a crime 100% anonymously by completing our online form or calling 0800 555 111

Youth support services

Access a selection of youth organisations who can offer further information, advice and support for whatever you're dealing with.